Author: Sara Kowalke

Optimal Blue Originations Market Monitor: Lock Volume Rises 36% Month Over Month in January, Falling Rates and Slowing Decline in Purchase Counts May Signal Lending Relief in 2024

PLANO, Texas – Feb. 12, 2024 – Today, Optimal Blue announced the release of its Originations Market Monitor report, looking at mortgage origination data through January month-end. Leveraging daily rate lock data from the Optimal Blue PPE – the industry’s most widely used product, pricing, and eligibility engine – the Originations Market Monitor provides a comprehensive and timely view into origination activity.

“The new year kicked off with continued rate relief and a 36% month-over-month gain in total lock volume, driven by a seasonal 38% increase in purchase lock volume,” said Brennan O’Connell, director of data solutions, Optimal Blue. “We also saw the smallest year-over-year decline in purchase lock counts since May 2022, which may foreshadow a stabilizing market and friendlier lending environment in 2024.”

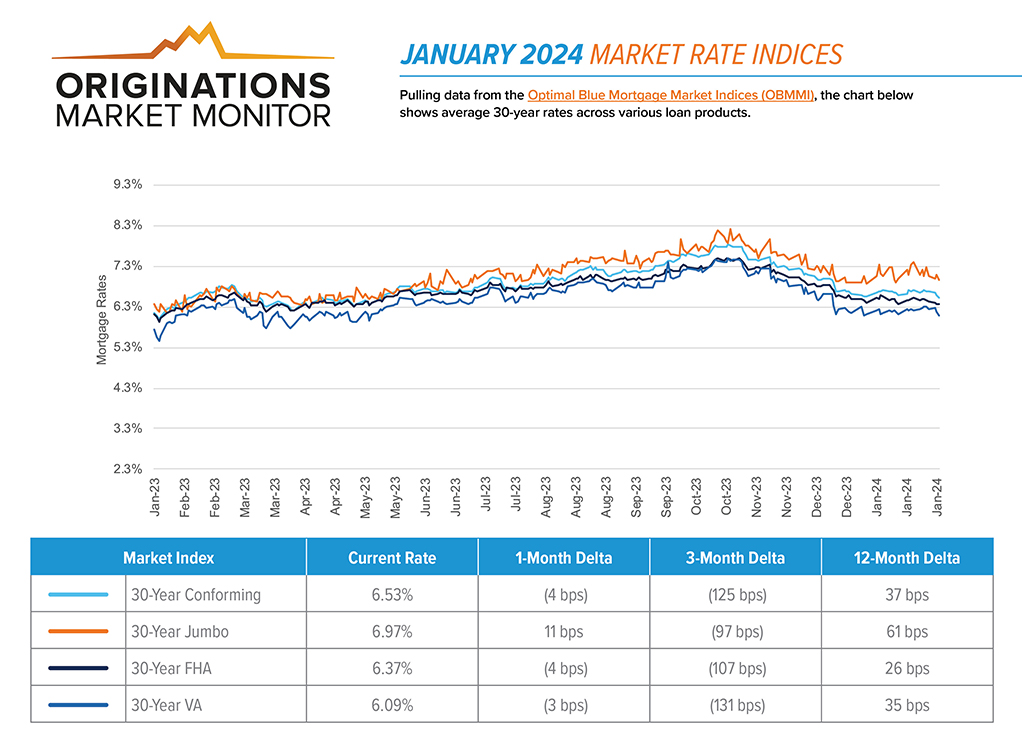

In addition to the month-over-month climb in purchase lock volume, cash-out and rate/term refinance volumes rose 30% and 20%, respectively. The Optimal Blue Mortgage Market Indices (OBMMI) 30-year conforming rate dropped 4 basis points (bps) in January to finish the month at 6.53% after a mid-month peak at 6.7%. FHA and VA rates also fell in January, dropping 4 bps and 3 bps, respectively, while jumbo rates moved in the other direction with an 11-bps increase since year-end.

Mortgage rates fell despite a month-over-month 15-bps increase in the 10-year Treasury yield in January, leading to a 19-bps narrowing of the mortgage-to-Treasury spread. At approximately 250 bps, the January spread reached levels unseen since mid-2022. While still elevated relative to historical averages, the spread has narrowed significantly since eclipsing 300 bps on multiple occasions in 2023.

Conforming products gained market share to start the year, rising 72 bps to account for 57.3% of total volume. Non-comforming products – including jumbo and non-QM – rose 27 bps to make up 9.7% of total volume. Ginnie Mae-eligible products moved inversely, however, with the FHA share dropping 87 bps and the VA share falling 13 bps, each representing 20.7% and 11.7% of total volume, respectively. The share of adjustable-rate mortgage (ARM) products stayed consistent at just above 5% of total volume. Improving rate conditions and an inverted yield curve have limited the demand for ARM loans.

The rise in lock volume coincided with a January climb in average credit scores across all products and loan purposes. The average loan amount also rose, increasing from $349.5K to $355.6K. Finally, after six consecutive months of decline, the average home purchase price rebounded, jumping from $435.9K to $444.9K.

Each month’s Originations Market Monitor provides high-level origination metrics for the U.S. and the top 20 metropolitan statistical areas (MSAs) by share of total origination volume. View the Originations Market Monitor report for more detail on January activity.

Nothing herein shall be construed as, nor is Optimal Blue providing, any legal, trading, hedging, or financial advice.

About Optimal Blue

Optimal Blue is a market leader in mortgage secondary marketing technology. The company facilitates transactions among mortgage market participants through its Marketplace Platform, actionable data, and technology vendor connections. The platform supports a range of functions for originators and investors to automate and optimize core processes related to product, pricing, and eligibility, hedge analytics, MSR valuation, loan trading, social media compliance, and counterparty oversight. The company’s premier products are used by 68% of the top 500 mortgage lenders in the U.S. For more information on Optimal Blue’s end-to-end secondary marketing automation, visit OptimalBlue.com.

# # #

Media contact:

Olivia DeLancey

904.854.5459

Olivia.DeLancey@OptimalBlue.com

| View Report |

PLANO, Texas – Feb. 2, 2024 – Today, Optimal Blue announced its selection by HousingWire as a Tech100 Mortgage award winner. Now in its 12th year, HousingWire’s Tech100 award program spotlights the most innovative and impactful tech organizations in housing.

“We are honored to be recognized by HousingWire for our end-to-end capital markets platform, which connects hundreds of thousands of individual lenders, investors, brokers and vendors across the primary and secondary mortgage markets,” said Scott Smith, interim CEO at Optimal Blue. “Optimal Blue is continually investing in product innovation that enables our customers to operate more nimbly, efficiently and profitably, while at the same time growing our bench of experienced industry advisors and services staff.”

Optimal Blue is an undisputed leader in mortgage secondary marketing technology, facilitating more than $1.1 trillion in mortgage locking and trading transactions annually. Its technology and data solutions are relied on by thousands of lenders and brokers, and hundreds of investors, as well as government agencies, think tanks, and others. The company’s solutions are used by 68% of the top 500 mortgage lenders in the U.S.

Optimal Blue continues to invest in its market-leading position with a focus on enhanced user experience, cloud-first and cloud-native technology, world-class mobile solutions, and premier workflow, rules, and compliance technology.

“The technology capabilities and solutions that this year’s Tech100 winning organizations have developed are an absolute testament to the relentless innovation within the real estate and mortgage technology landscape,” HW Media Editor-in-Chief Sarah Wheeler said. “These past few years have been transformative for the industry and these honorees are continuing to bring long-awaited solutions to the challenges that mortgage and real estate professionals have struggled with for decades. Congratulations to all the deserving winners for their outstanding contributions to our ever-evolving industry.”

About Optimal Blue

Optimal Blue is a market leader in mortgage secondary marketing technology. The company facilitates transactions among mortgage market participants through its Marketplace Platform, actionable data, and technology vendor connections. The platform supports a range of functions for originators and investors to automate and optimize core processes related to product, pricing, and eligibility, hedge analytics, MSR valuation, loan trading, social media compliance, and counterparty oversight. The company’s premier products are used by 68% of the top 500 mortgage lenders in the U.S. For more information on Optimal Blue’s end-to-end secondary marketing automation, visit http://www.OptimalBlue.com.

# # #

Media Contact

Olivia DeLancey, Optimal Blue

904.854.5459

Olivia.DeLancey@OptimalBlue.com