STEP 1: EXPLORE

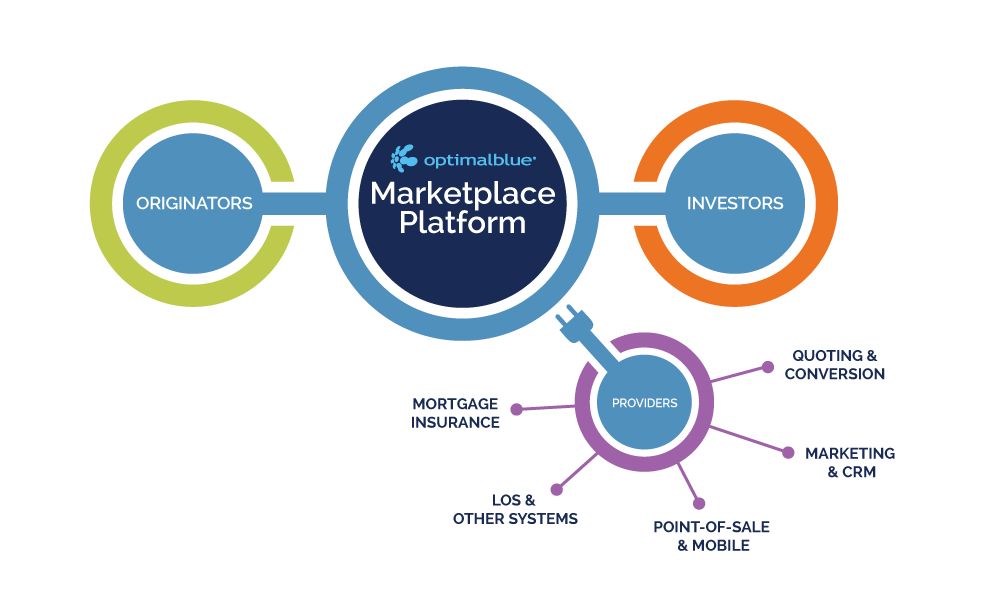

DISCOVER OUR PARTNER NETWORK

With more mortgage technology providers offering innovative solutions than any other time in history, today's lenders are advantaged with more choice than ever before! However, knowing which solutions are integrated with your systems has become more and more difficult.

Optimal Blue’s Partner Network takes the guesswork out of vendor integration by offering a robust library of certified integrations with the technology innovators you rely upon today and tomorrow.