— Real-time data provides insights into competitive position, market trends, and risk mitigation strategies during uncertain times —

The transition from 2019 into 2020 proved to be more difficult for mortgage lenders than in past years. In the switch of a year and the blink of an eye, the world changed dramatically.

The first quarter of 2020 ushered in a sea of change, including a worldwide pandemic, national and state stay-at-home orders, significant economic challenges, business shutdowns, record unemployment, and more.

Yet, despite it all and fueled by a lengthy period of historically low rates, today’s lenders generated a record number of mortgage rate locks in the first quarter — production levels rarely experienced in our industry.

As the federal government continued to provide stimulus and assistance to consumers, businesses and the economy as a whole, the challenging market volatility experienced in Q1 of 2020 did not subside in the second quarter. Nor did the heavy mortgage volumes.

Mortgage investors and servicers changed pricing, product eligibility requirements and underwriting standards at a record clip, further multiplying the complexities facing mortgage lenders. Now, as many states begin to open back up and start their economic engines, opportunities and challenges are once again shifting.

No matter what comes next, successful mortgage lenders have learned that maximum market transparency is the key to anticipating and understanding rapidly changing conditions.

Real-time data and comprehensive analytics are at the heart of market transparency, providing highly sought-after insights into competitive position, market trends and risk mitigation strategies amid these uncertain times.

Although Optimal Blue did not initially develop its actionable data and analytics products with a global pandemic in mind, they serve as a perfect fit for what lenders need in this volatile and dynamic environment.

The largest single source of rate lock data, Optimal Blue provides the mortgage industry with information on pricing and key transaction variables 60 to 90 days before closing data is available.

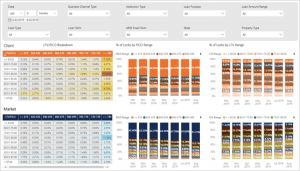

Updated daily, Optimal Blue’s rate lock data is deep and comprehensive, including a robust set of transactional data elements such as loan product, property type, LTV, FICO, geographical location, borrower demographics and more.

Representing over one-third of all mortgage loans completed within the industry every year, Optimal Blue’s platform locks more than $1 trillion of mortgage loans annually.

Optimal Blue’s actionable data and analytics products provide clients and partners with highly granular, early insights across the entire mortgage market. Delivered in raw data form and through a visually compelling analytics tool, Optimal Blue has drawn particularly strong interest from a diverse array of companies, including mortgage lenders, mortgage investors, investment firms and industry regulators.

In addition, attention has grown across public policy think tanks that study the mortgage industry, such as the American Enterprise Institute (AEI), as well as risk analytics and consulting firms for residential loans and MBS, and mortgage insurance providers like Genworth. Optimal Blue’s data and analytics enable users within those companies to:

1. Benchmark against the competition.

In today’s highly competitive industry, lenders need to not only understand their position relative to their competition but also have access to the tools that provide visibility into those specifics. Optimal Blue’s data and analytics products provide that sought-after transparency.

Lenders that use Optimal Blue’s Product & Pricing Solution can leverage Optimal Blue’s Competitive Analytics to more effectively analyze the competition, understand overall market composition, create competitive comparisons in real time and effectively evaluate how their margins measure up — both as a whole and at the more detailed, MSA level. This can help inform smarter lending strategies and decisions moving forward.

“Lenders that utilize Competitive Analytics are far better equipped to make agile decisions and take appropriate action, particularly in times of market uncertainty and fluctuation,” said Rick Allen, vice president of Business Transformation at Optimal Blue. “Their ability to remain nimble is in large part due to their use of a real-time, transactional data set as opposed to surveyed or aged data.”

For lenders that are not using Optimal Blue’s Product & Pricing Solution, Optimal Blue’s Market Analytics product enables any lender to benchmark their production against the broader market in a variety of different ways, including loan types, rate and price, FICO, LTV and more.

2. Focus marketing efforts.

When analytics are broken down at the geographical level, lenders gain visibility into new opportunities, have the power to better refine their outreach efforts and make more effective use of marketing dollars.

Optimal Blue’s Competitive Analytics product analyzes transactional mortgage data on over 350 MSAs across the country, offering visibility into local loan volume, pricing and other trends. Each granular filter enables the lender to hone into specific loan programs and assess trends across various timeframes, and due to the diversity and extensive reach of Optimal Blue’s network, data is available on a wide range of scenarios.

Lenders can then leverage this data to identify high-potential markets and better allocate financial and human resources. It can also cut down on wasted ad spend.

3. Understand borrower segments.

Borrowers can vary widely from one market to the next, in profile and in behavior. Actionable analytics can help lenders better grasp these market-level nuances, offering insights into borrower credit scores, LTV, DTI, loan amounts, property types and more. Further, they can even spot trends related to loan use which can inform better investment, hedging and resource allocation decisions.

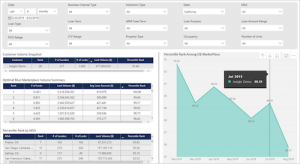

AEI Housing Center produces a weekly research product focused specifically on the mortgage industry, called the “AEI Housing Market Nowcast” (formerly the Flash HMI Report). Released every Monday, the Housing Market Nowcast provides much-needed and timely insights on the single-family residential housing market convulsing from the effects of the Coronavirus Disease 2019 (COVID-19) pandemic.

“Using newly acquired data from Optimal Blue, the AEI Housing Center is now able to provide near-real-time market indicators on purchase loan rate lock volume, home price, credit, and cash out refinance trends,” said Ed Pinto, resident fellow and director of the AEI Housing Center.

“After extensive historical analysis of Optimal Blue data going back seven years, we have concluded that this rate lock data tracks closely with that which is reported in our National Mortgage Risk Index (NMRI), covering 99% of the agency market. As a result, today’s Housing Market Nowcast will provide an advanced look at tomorrow’s housing market as today’s rate locks will become next month’s home purchases and mortgages.”

4. Predict and leverage industry-wide trends.

Optimal Blue’s Market Analytics product enables users to better understand ongoing market tendencies, including trends in refinancing, specific loan products, home price trends and mortgage volume as a whole.

Because of its frequency, depth and overall position in the mortgage process, Market Analytics users gain an early indication of closing volume months before it occurs. Confidently understanding the mix of business that the industry will close in future months can be an immense benefit to lenders and other firms, such as mortgage insurance companies, that provide valuable services to the mortgage industry.

“In order to remain a committed, long-term provider of relevant products and services to the mortgage industry, it is imperative that Genworth closely monitors the trends, hotspots, and overall mix of business within industry,” said Kevin McMahon, senior vice president of Customer Solutions at Genworth. “Because Optimal Blue’s data and analytics products leverage actual mortgage rate lock data, our company has early and very detailed insight into industry closing activity, months before it occurs.”

5. Fine-tune MBS and MSR analytics to effectively mitigate risk.

With access to loan-level pricing, rate and loan data that covers over one-third of the market, lenders can improve predictive modeling efforts and reduce risk. Various studies using Optimal Blue’s Mortgage Market Indices (“OBMMI”) or custom indices derived from Optimal Blue’s Market Analytics product have shown the increased precision of using a more granular and accurate primary rate input, which can significantly improve prepayment modeling and estimates of refinance propensity.

The depth and granularity of Optimal Blue’s data may also help lenders and risk analytics and consulting firms for residential loans and MBS, like Andrew Davidson & Co., Inc. (AD&Co.), produce more vigorous prepayment forecasts in the future. Because the data is based on actual rates locked by consumers and fully reflects all risk-based pricing adjustments, it is proven to be more precise than the static risk-based spreads that many firms use for MBS and MSR analytics. A more accurate primary rate input results in a better prepayment prediction, which helps drive improved buy/sell and pricing decisions.

“Accurate and timely market data should be a part of every modeler’s toolkit,” explained Sanj Chatterjee, director of Modeling for Andrew Davidson & Co. “Optimal Blue’s rate lock data helps us monitor the evolution of rates on a continuous basis, especially for FHA, VA and jumbo prime loans.”

Making the case for data & analytics

Data and analytics that enable participants to benchmark against the competition and understand the impact of trends as early as possible are status quo in most every industry. While this level of granular business intelligence has always been important, conditions are now changing at such a pace that it would be incredibly difficult for any lender to keep up without it.

Being able to make informed decisions amid rapidly changing conditions, and doing so in near real time, leads to more effective and more profitable results — making actionable data and analytics a critical ingredient of success over the long haul.

“Operating in today’s volatile mortgage market without the right data is like taking a road trip without your GPS,” Allen concluded. “You might find your way with a lot of trial and error, but it won’t be the best or most economical path forward by any means.”

This piece was originally featured on HousingWire.com.

###

PRESS CONTACT FOR OPTIMAL BLUE

Robert J. Brandt

Vice President, Marketing & Strategic Alliances

(469) 609-5585

bbrandt@optimalblue.com