ENSURE COMPLIANCE

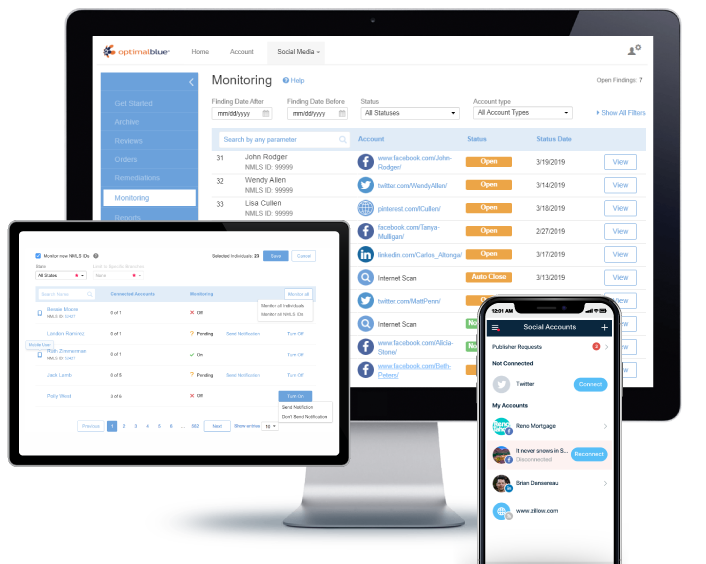

AUTOMATED MONITORING & AUDITS

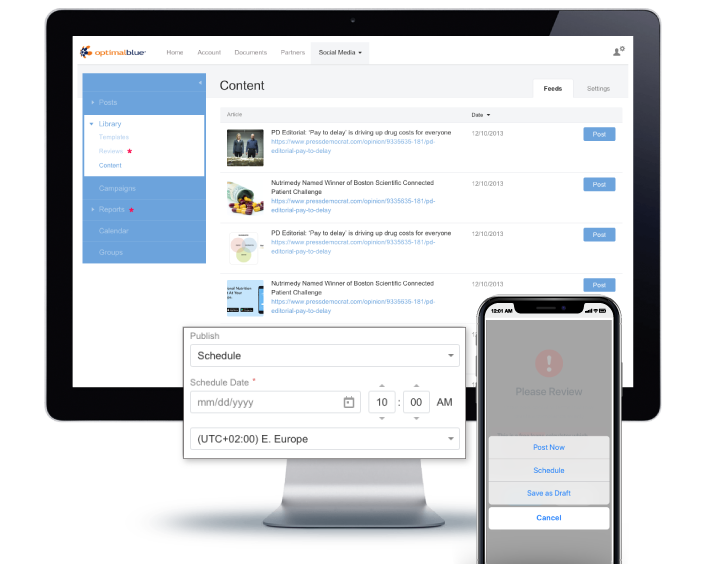

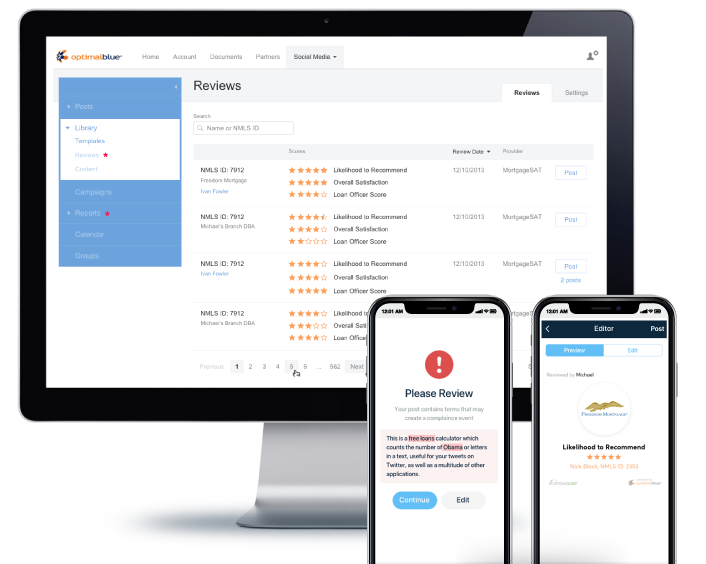

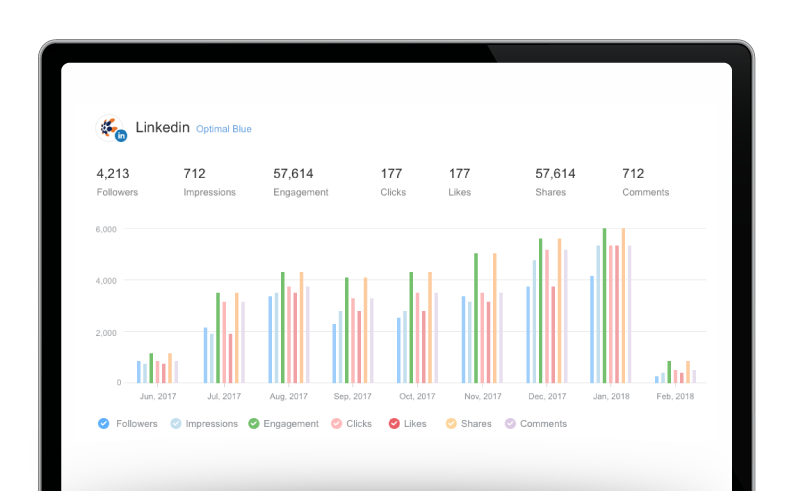

Automated, ongoing monitoring enables 24/7, real-time oversight of social media activities involving your company. Additionally, comprehensive audit reviews are available to review all targeted social media activities and venues.

Both are a simple way to proactively find and correct issues, ensure compliance, and save valuable time and money.