Want to Know How Your Mortgage Company Ranks Against the Competition?

— With Optimal Blue’s Competitive Analytics, lenders get anonymized transactional data that’s updated daily —

In any industry, it’s hard to win if you don’t know what your competition is doing. Traditionally, lenders have relied upon just a few very limited options to do so, such as often flawed survey data based on a very small market sampling, latent servicing data illustrating what business looked like six or more months ago, or an annual HMDA ranking. Suffice to say, none of these resources enabled them to effectively compare the current state of their business to those they compete with.

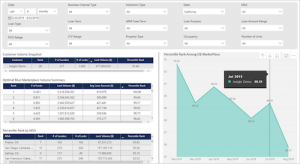

Optimal Blue has upended those concerns with a powerful new business intelligence offering called Competitive Analytics. This solution touts daily updates of comprehensive transactional data and features insightful visualizations that can be configured through a variety of highly granular filters.

Competitive Analytics is powered by data from actual mortgage transactions across the country and is updated every night, providing the most accurate, granular, and timely view of mortgage transactions available in the industry.

Further, the solution enables lenders to benchmark their results against the overall market in the areas that matter most, resulting in far more informed corporate decision-making and highly targeted lending strategies.

“Competitive Analytics is the only product available to lenders that provides such an extraordinary level of market transparency and sophisticated business intelligence,” said Optimal Blue CEO, Scott Happ. “Our clients are incredibly excited about their ability to benchmark against peers, as well as with the wealth of innovative new tools to create, adapt, and confirm winning business strategies.”

Optimal Blue’s market share is what makes this competitive analysis possible. As the largest provider of secondary marketing automation to the mortgage industry, Optimal Blue floats on a sea of operational and transactional data. One of every three mortgage loans completed nationwide every year are priced and locked through the Optimal Blue platform, uniquely positioning the company to provide meaningful and unrivaled benchmarks.

Competitive Analytics uses fully anonymized transactional data, a game-changer for Optimal Blue clients concerned about compliance and privacy. The company laid the foundation for its suite of business intelligence solutions by investing heavily in data infrastructure, building its data warehouse from the ground up and partnering with Microsoft to house and analyze Optimal Blue data in Microsoft’s Azure Data Lake.

How competitive are my lending strategies?

One of the many hallmarks of the Competitive Analytics solution lies in the advanced filtering capabilities, which were built and designed with extensive client feedback.

With Competitive Analytics, lenders can easily determine whether their market share is growing or declining and how it’s evolving over any configurable range of time. Lenders can choose to filter by loan type, loan purpose, and loan amount. They can also drill down by state, MSA level, or a user-defined market area to gauge their performance as it relates to FICO range, LTV, property type, occupancy, and more.

“Competitive Analytics enables insightful decisions that ignite action by intelligently grouping large chunks of data for comparison, and then providing lenders the tools to slice that data however they want,” explained Erin Wester, senior product manager.

The data that populates Competitive Analytics is interactive and interrelated, allowing lenders to observe trends across a diverse set of product and borrower profiles at the same time.

For example, a lender can see that they are closely aligned with the market in northwest Texas on conforming loans with credit scores over 680 and loan-to-value ratios above 80%, while also confirming an opportunity for growth in an entirely new market, like California, where they have been considering an FHA, non-conforming, or non-qualifying mortgage (Non-QM) product offering aimed at specific borrower profiles.

How does my profitability stack-up?

While Competitive Analytics does a masterful job at providing visibility into market share, its value continues through unique insights into lender profitability.

Users can compare rate and price to determine where they are operating at a higher or lower margin than others – with or without the impact of loan officer compensation. Then, directly next to those visualizations, Optimal Blue clients can also see what portion of their margins are being eroded by concessions and how concessions offered compare to the overall marketplace.

“It’s easy to overwhelm people with data. We wanted to provide out-of-the box capabilities to dig deep on front-of-mind questions, like whether their price is competitive and how their margins or concessions compare to other lenders in their producing markets,” Wester said.

“This really gets into profitability, not only providing lenders with the tools to highlight where they are most competitive, but – more importantly – illustrating where they can adjust resources and strategies to be even more competitive and profitable.”

Where do I rank in my current (or future) markets?

Another unique feature of Competitive Analytics is the analysis into the efficiency of a lender’s lock desk. A comprehensive volume snapshot lets lenders view their rank based on their number of locks and lock volume, as well as post-lock changes.

The unique and well-known lock desk management functionality of Optimal Blue’s PPE powers the data collection of how many change requests a lender receives and how long it takes to process those changes.

By leveraging that data, Competitive Analytics empowers lenders with deep visibility into their operations and unique comparisons to the overall market to inform profitable strategies, drive new efficiencies, and create competitive differentiation.

“The lock desk is a critical and expensive part of a mortgage operation and lenders are hungry to see how efficient and productive they are compared to others,” Happ said. “Optimal Blue is not only building software to support a more efficient, lights-out lock desk, but we now provide the visualizations to illustrate that efficiency in relation to their competition.”

Optimal Blue’s data engineering, data science, and product management teams worked hard to make the solution’s visualizations as compelling as possible so lenders can quickly understand and act on the analysis. The teams drew on the experience they gained in creating Optimal Blue’s Enterprise Analytics solution, which has received rave user reviews since being released two years ago.

Additionally, as part of an ongoing corporate effort to align product development closely to client needs, Optimal Blue’s product team conducted numerous collaborative feedback sessions with clients on Competitive Analytics through popular nationwide roadshows, conferences, and webinars. The results were impactful.

Ultimately, business intelligence that leads to improved efficiencies and a more competitive offering helps lenders better serve their most important stakeholder: the borrower. Daily insight into successful strategies to better serve borrowers and grow their businesses is the differentiating factor that lenders need in the current mortgage landscape.

“We are proud to announce the release of Competitive Analytics, which joins an established and growing base of data services offerings,” Happ concludes. “Optimal Blue is committed to helping our lenders visualize their business in new and unique ways, implement strategies to help them further differentiate, and aide them in their journey to better serve today’s mortgage borrower.”

This piece was originally featured on HousingWire.com.

###

PRESS CONTACT FOR OPTIMAL BLUE

Robert J. Brandt

Vice President, Marketing & Strategic Alliances

(469) 609-5585

bbrandt@optimalblue.com