COMPASSEDGE

Comprehensive hedging and loan trading functionality

in one, user-friendly platform

CompassEdge combines unmatched pipeline risk management tools and analytics with dynamic loan sale and MSR valuation functionality.

NEW INNOVATIONS IN OPTIMAL BLUE’S COMPASSEDGE

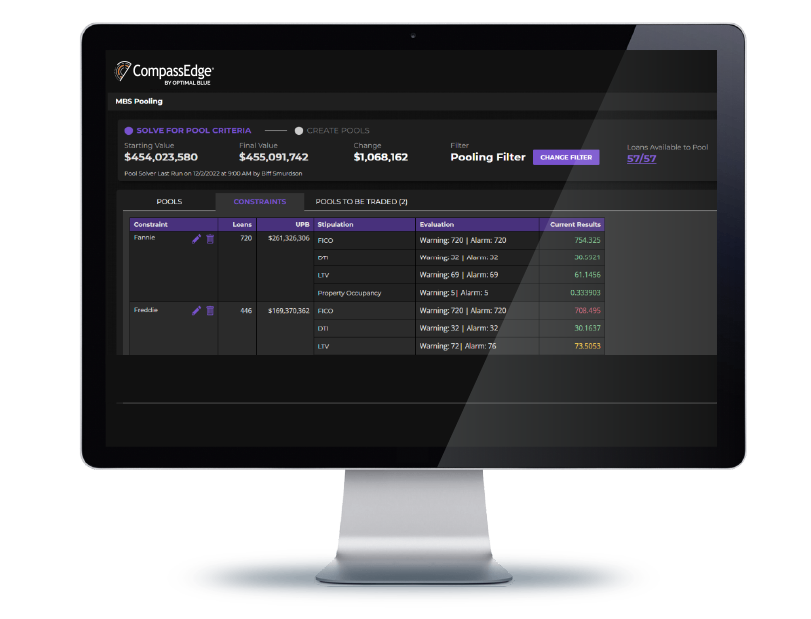

Pool Solver

Automate loan pooling with precision and speed – no manual work required.

Pool Solver, part of the CompassEdge hedging and loan trading platform, replaces manual Excel-based pooling with a powerful solver algorithm that forms investor-eligible loan pools in minutes. By applying investor-specific constraints with 99.99% accuracy, Pool Solver ensures compliance, boosts execution value, and saves hours of manual effort – no matter your institution’s size.

Automated optimization: Instantly form compliant loan pools using investor-specific rules like high balance limits and de minimis thresholds.

Execution-first logic: Aggregate best-ex logic prioritizes total pool value – even if it means pulling a loan from its top individual price.

No spreadsheets, no errors: Eliminate manual entry and reduce risk with solver-driven accuracy.

Scalable and simple: Works out-of-the-box for both high-volume and smaller institutions with minimal configuration.

Built into CompassEdge: Seamless integration means no additional setup or IT lift required.

Pool Solver is the only solution that brings this level of automation and precision to the pooling process – making it faster, smarter, and easier to scale.

NEW INNOVATIONS IN OPTIMAL BLUE’S COMPASSEDGE

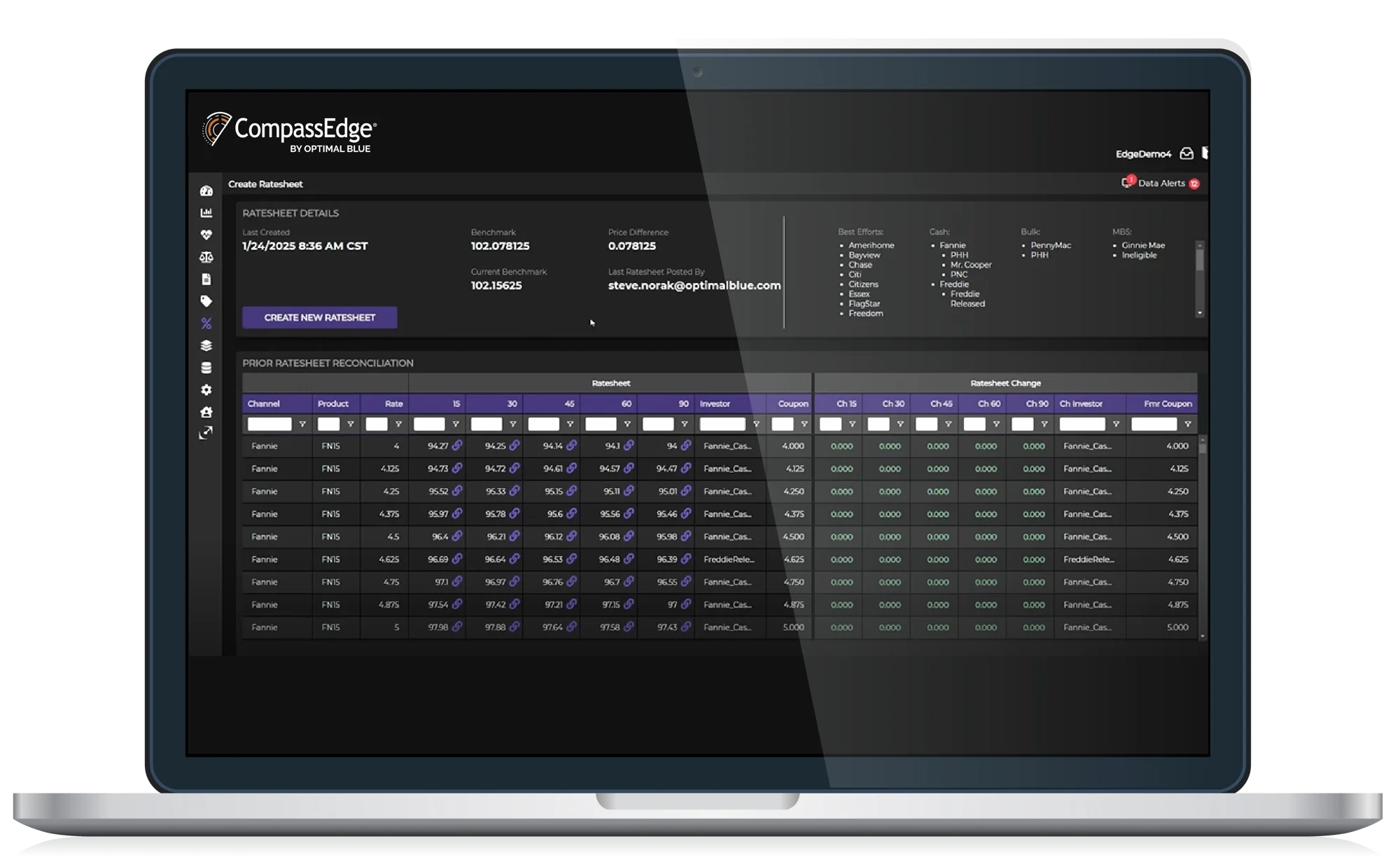

CompassEdge Ratesheet Tool

Connect front-end pricing with back-end pricing

The Ratesheet Tool connects front-end pricing (i.e., origination) with back-end pricing (i.e., secondary) to allow lenders to generate ratesheet pricing with a known margin, accurately. Linking to both the Optimal Blue PPE and the CompassEdge hedging and loan trading platform, the Ratesheet Tool allows secondary users to access a back-end price and deliver a more accurate execution price to originators.

Offers a new way for lenders to generate ratesheets with their own proprietary pricing.

Ensures precision and accuracy from secondary to origination.

Manage risk at the point of origination through the seamless, end-to-end connection of the Optimal Blue ecosystem.

Incorporate any execution method for front-end pricing including best efforts, agency cash, agency MBS various servicing valuations, and even bulk bid valuations.

NEW INNOVATIONS IN OPTIMAL BLUE’S COMPASSEDGE

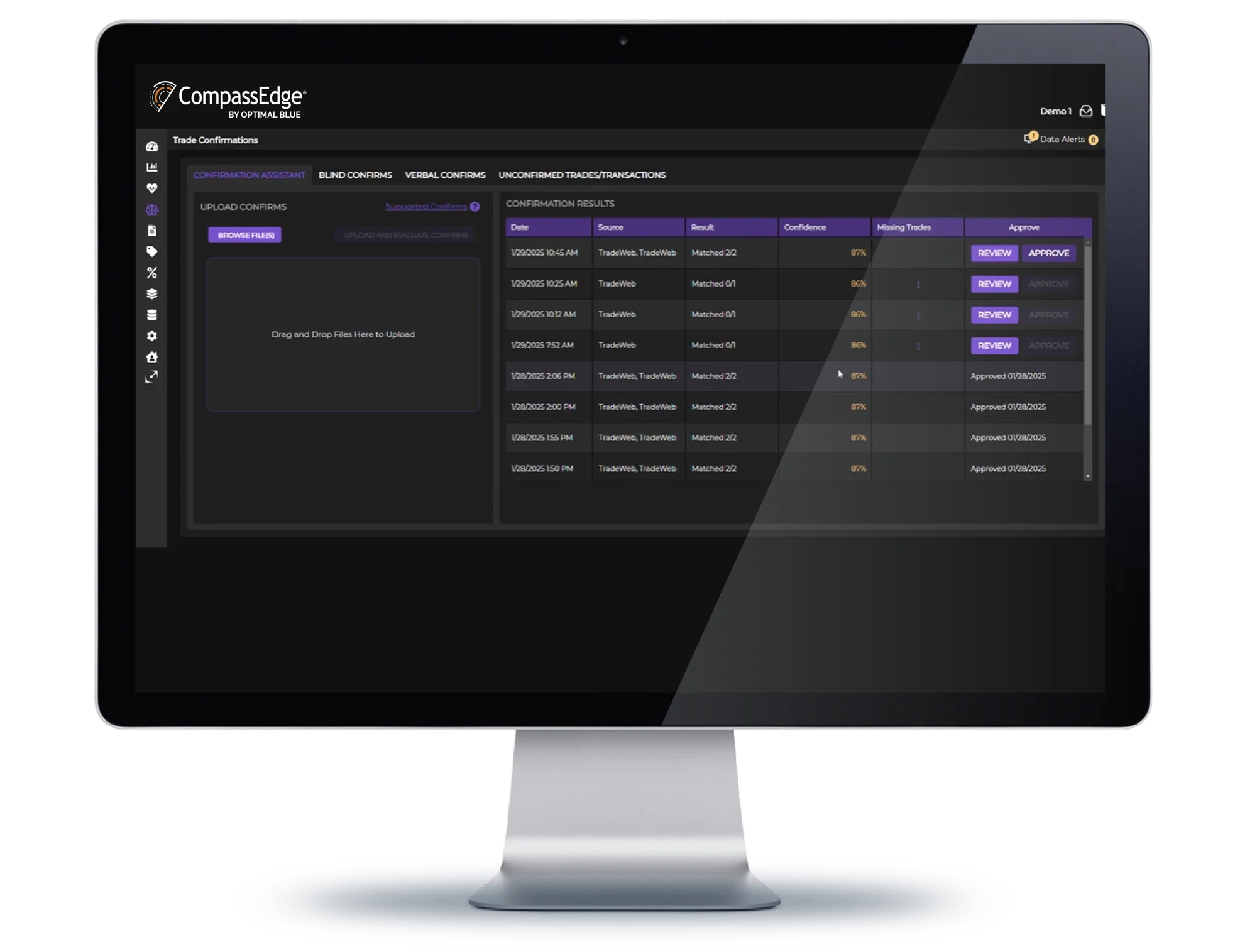

Confirm Assistant

Confirm Assistant is a feature that reduces both the time and potential for manual errors associated with reading and intaking TBA trade confirmation files. The tool uses AI analysis to read files from broker-dealers, parsing the documents into usable formats.

Simply drag and drop confirmation files and approve them without having to manually key in data.

Reduce manual, time-consuming steps and freeing up staff to focus on more complex trades.

Flexibility to change service levels without having to change staffing levels.

POWERFUL AI TOOLS

MAXIMIZE PROFITABILITY WITH AI ASSISTANTS

Maximize profitability on every loan and optimize your advantage with AI Assistants in the CompassEdge hedging and loan trading platform – the Profitability Assistant, Projections Assistant, Position Assistant, and Trade Assistant.

POSITION ASSISTANT

Receive daily, data-driven insights to transform your mortgage risk management.

Position Assistant offers critical daily insights into changes in risk exposure by automatically summarizing the top drivers impacting hedged mortgage pipeline positions. By analyzing factors such as loan volume changes and hedging adjustments, lenders receive a comprehensive overview that helps them to quickly assess and adjust their risk.

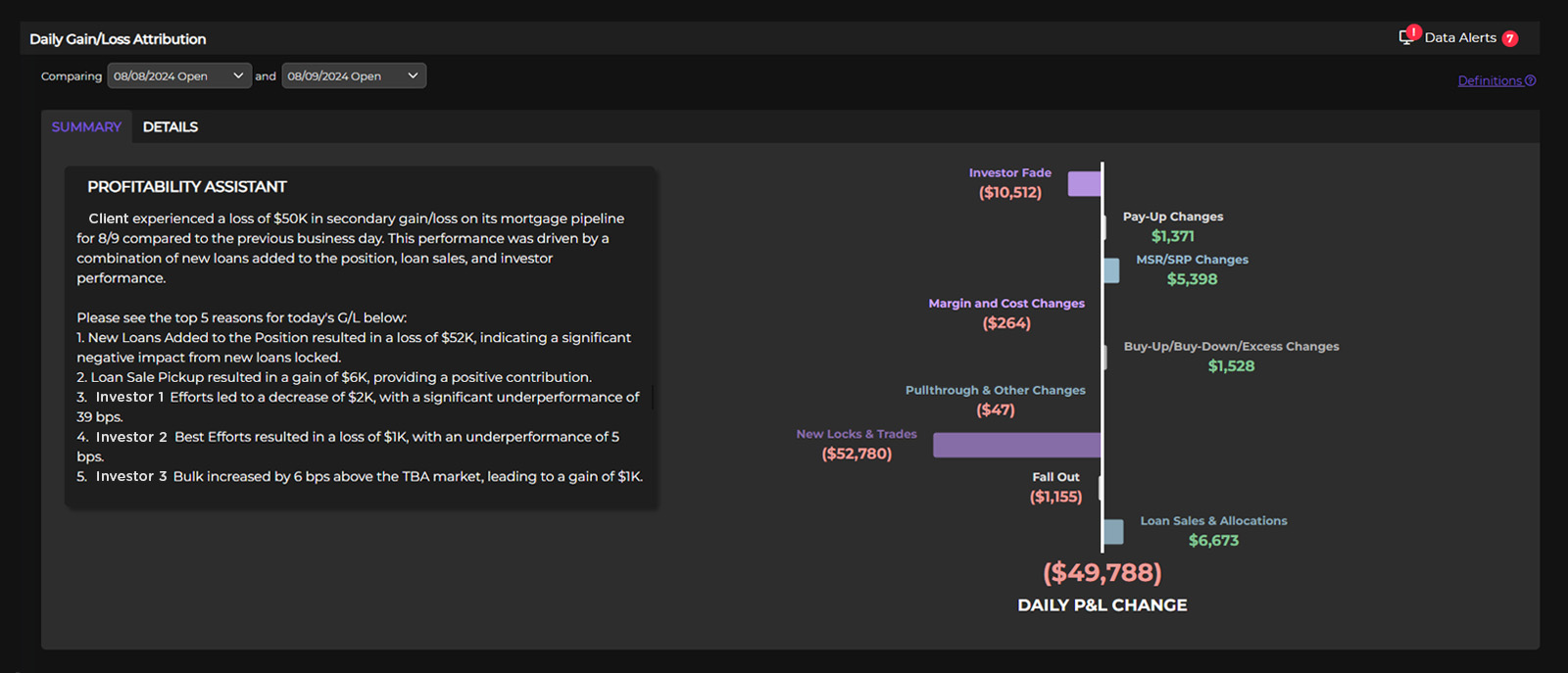

PROFITABILITY ASSISTANT

Quickly identify and explain profitability changes in your mortgage pipeline.

Profitability Assistant uses generative AI to summarize the top drivers of profitability gains or losses, including new locks, fallout, loan sales, and bulk AOT. Designed for CFOs and executive teams, these day-over-day changes and month-to-date summaries enhance transparency between secondary and the the C-suite.

PROJECTIONS ASSISTANT

Predict future pipeline profitability with ease.

Projections Assistant uses AI to forecast the impact of various factors on a hedged mortgage pipeline, such as originations, fallout, and loan sales. It automates complex calculations to deliver detailed projections for position management.

TRADE ASSISTANT

Get data-driven hedge recommendations aligned with your policy.

Trade Assistant uses AI to suggest optimal combinations of sells, buys, rolls, and swaps, reducing the guesswork in hedge selection and minimizing transaction costs.

COMPREHENSIVE PLATFORM

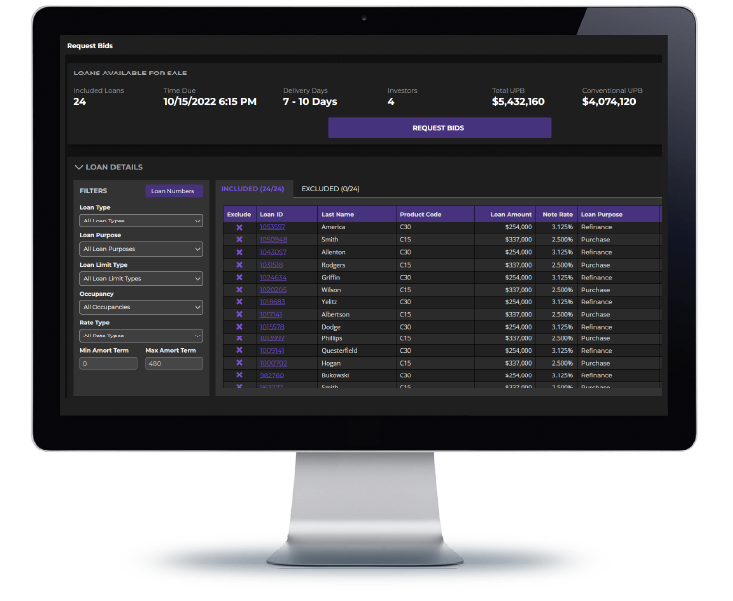

MAXIMIZE HEDGING AND LOAN TRADING STRATEGIES

CompassEdge combines the strengths of preceding hedging and trading solutions to offer world-class analytics, ease-of-use and true best execution in one, unified platform. CompassEdge helps enhance risk management and loan trading strategies with:

Scalability to suit any lender

All the functionality needed for loan sales, including:

Pool optimization

Loan-level MSR valuation

Specified pay-ups

Integrations with agencies and investors

Premier analytics, including pull-through

Durations, including:

Specified durations

Granular G/L reconciliation

Channel/branch/loan officer scorecard

Tools focused on transparency

Resilient, cloud-based infrastructure

Open-platform architecture

INTUITIVE INTERFACE AND NAVIGATION

ACCESS COMPLETE FUNCTIONALITY WITH ONE LOGIN

CompassEdge presents relevant, actionable tools in a modern interface with streamlined navigation. Any credentialed capital markets participant – from the lock desk, to the C-suite – can access key data and functions without in-depth system training. Experience more efficient and user-friendly hedging and loan trading processes with:

Modern “dark mode” interface

Key data and tools on homepage

Real-time report visible to all users

Mobile-friendly dashboards

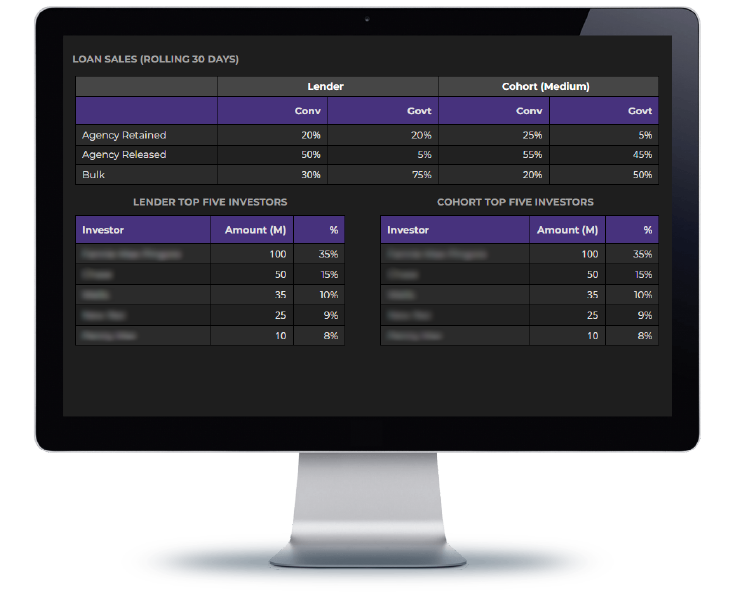

UNPARALLELED KNOWLEDGE

INFORM STRATEGIES WITH DATA AND EXPERTISE

Through enhanced visibility, CompassEdge amplifies the already-outstanding support the Optimal Blue team delivers to clients with peer information at the forefront. The data information supplied from CompassEdge serves as strategic checks to daily processes and helps users make strategic decisions more quickly. CompassEdge users have unique access to data and industry knowledge that includes:

Extensive peer data on loan sales, hedging, pricing and more

Data from the Optimal Blue PPE

Support from industry experts

Expertise backed by decades of experience

RELATED SOLUTIONS

Leverage Optimal Blue's end-to-end secondary marketing automation and data services to improve accuracy, maximize profitability and workflow efficiencies, and create corporate transparency.