Make Better Decisions Faster With AI and Automation From Optimal Blue

AI-Powered Recommendation Engine

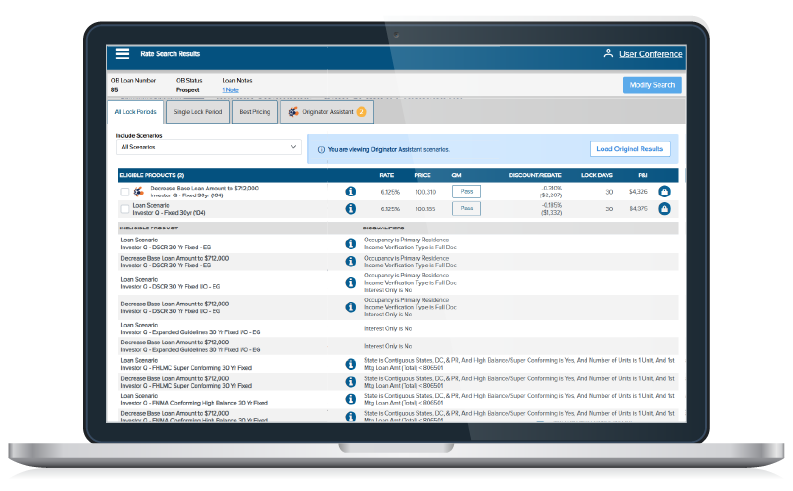

Originator Assistant leverages generative AI to eliminate human bias and instantly surface alternate loan scenarios with more competitive pricing and options for borrowers.

Executive AI Assistant

Interact with your Optimal Blue data using natural language prompts with Ask Obi. Get instant, actionable insights and visualizations for smarter, faster decisions.

Automated Profitability Analysis

Profitability Assistant in CompassEdge summarizes the top drivers of pipeline gains or losses with AI-powered analytics that bridge secondary and executive strategy.

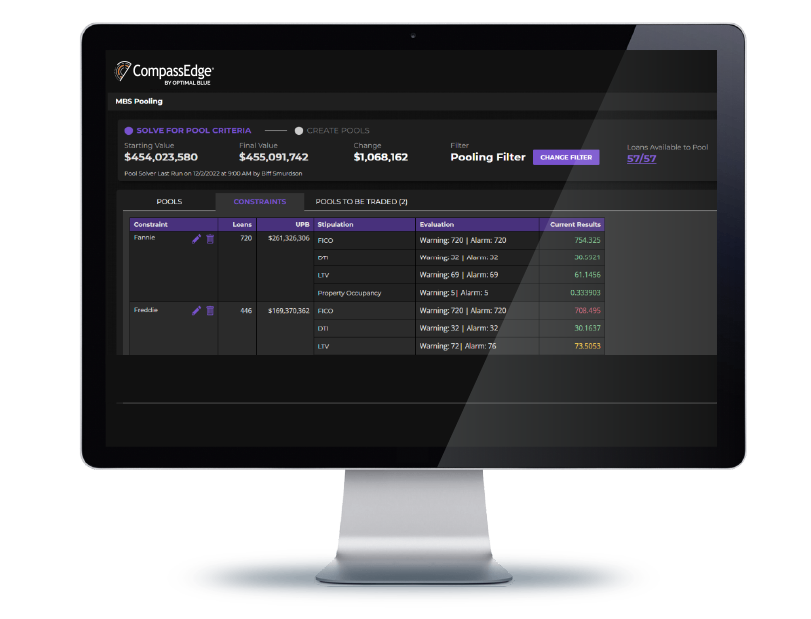

Automated Pool Optimization

Optimize loan pooling with investor-specific logic – no manual review of spreadsheets needed – with Pool Solver.

Automated Refinance Prospecting

Capture for Originators turns closed loans into future wins with automated refinance prospecting and borrower-ready presentations.

Seamless Integration & Accessibility

Many AI and automation tools are available to Optimal Blue clients at no additional cost – making innovation accessible for every lender.

AI + Real-World Mortgage Expertise

AI That Solves Real Challenges

Many companies talk about using AI in mortgage lending. Few have actually deployed it successfully – or understand the complexities of the problems they’re trying to solve.

At Optimal Blue, we combine proven expertise in capital markets with real-world experience using generative AI and machine learning. The result: highly targeted, use case–specific AI that delivers meaningful value with minimal risk. From smarter decision-making to reducing human bias, our AI is designed to help lenders act faster, more accurately, and with greater confidence.

Modern and Proven AI & Automation Power

Deliver precision, speed, and scalability with Optimal Blue’s trusted AI and automation solutions – empowering smarter decisions and automating complex workflows across the mortgage life cycle.

Measurable Results, Real Efficiency

Optimal Blue’s AI and automation tools help lenders save time, reduce errors, and maximize profitability – delivering real outcomes for institutions of all sizes.

Instant Insights, Effortless Execution

Optimal Blue’s platform combines real-time analytics, scenario recommendations, and automated processes – helping lenders act with confidence and efficiency.

ELIMINATE HUMAN BIAS, SURFACE BETTER OPTIONS

Originator Assistant instantly surfaces the most competitive loan scenarios for every borrower – using generative AI to deliver fast, accurate recommendations.

AUTOMATE LOAN POOLING WITH PRECISION

Pool Solver instantly forms investor-eligible loan pools using a powerful solver algorithm – eliminating manual spreadsheets and ensuring compliance with investor-specific rules.

Explore Latest Innovations

CAPTURE FOR ORIGINATORS

IN THE OPTIMAL BLUE PPE

Retention strategy and refinance analysis for originators

Streamline refinance prospecting with Capture for Originators, offering a dashboard and analysis of closed loans that goes beyond rate alerts saving loan officers time and effort. Send borrower-ready presentations in minutes.

BEST EFFORTS DIRECT LOCK

IN THE OPTIMAL BLUE PPE

Eliminate manual locking steps and accelerate efficiency through automation

Automate direct best-efforts locking with participating investors via API to eliminate manual steps, improve accuracy, and boost efficiency throughout the locking lifecycle.

ORIGINATOR ASSISTANT

IN THE OPTIMAL BLUE PPE

AI-powered recommendation engine eliminating bias

Leverage the power of AI to give loan officers recommendations and insights to help identify alternate loan scenarios to offer more options for borrowers.

Resources

AI in Mortgage – Real Use Cases, Real Impact

Optimal Blue CTO Seever Sulaiman shares how lenders can maximize and measure ROI on AI investments.

Unlocking Refi Potential Webinar

Learn how Capture for Originators turns past loans into future wins.

Optimizing Mortgage Strategy With AI, Data & Tech Trends

Chief Product Officer Erin Wester and Head of Corporate Strategy Mike Vough on AI, data, and smarter decision-making.

Choosing the Right Tech Partner: Modern Technology. Proven Experience.

Explore how Optimal Blue’s AI and automation solutions drive measurable ROI.