COUNTERPARTY OVERSIGHT

Drive compelling new efficiencies and confidently support third-party oversight due diligence and monitoring demands.

Leverage the mortgage industry's only fully automated and end-to-end counterparty oversight solution to efficiently and securely purchase loans from third-party originators with increased trust and confidence.

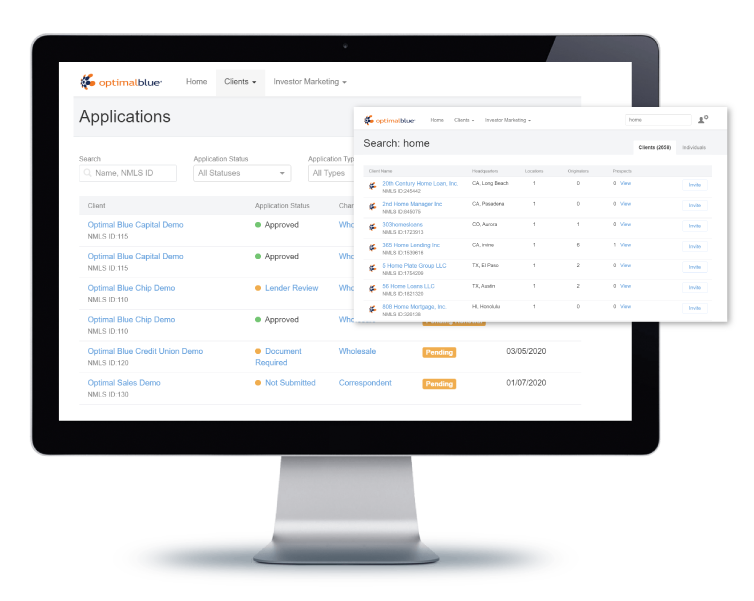

RELATIONSHIP MANAGEMENT

SIMPLIFY APPLICATION PROCESSES

With instantaneous access to every TPO and loan officer existing in NMLS® Consumer AccessSM, users are able to streamline strategic initiatives, as well as counterparty application and renewal processes, while simultaneously eliminating unnecessary inefficiencies, risks, and expenses.

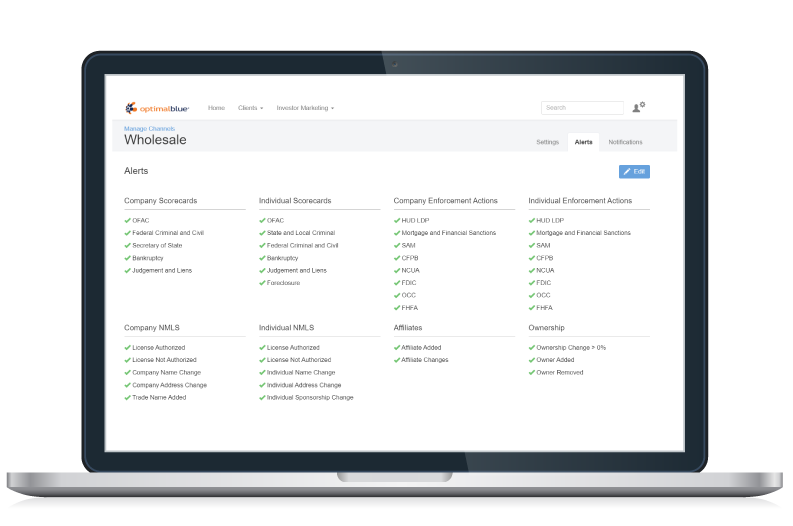

ENSURE COMPLIANCE

MANAGEMENT, MONITORING & DUE DILIGENCE

Our robust solution enforces the policies and procedures that you establish in your compliance management system. Continuous monitoring guarantees that organizational compliance is always current, while methodical automation improves accuracy and transparency to satisfy internal and external compliance requirements. Protect your business reputation and potential liabilities by meeting all regulatory requirements of the CFPB, FDIC, and NCUA.

AUTOMATE WORKFLOWS

ELECTRONICALLY MANAGE TPO DOCUMENTS

Leverage automation to simplify the collection and management of TPO documentation. Once a TPO uploads their documents, there is no need for them to provide those documents again. Due to integration with NMLS® Consumer AccessSM, our solution automatically populates stored data to streamline administrative tasks. All documentation associated with a TPO is easily retrievable in the system’s record library and comprehensive audit trails are always provided.

ATTAIN GROWTH & EXPANSION GOALS WITH EASE

In today’s evolving regulatory climate, it's vital to employ a solution that can effectively and efficiently support TPO due diligence and monitoring demands to achieve growth and expansion goals through automation, unmatched data consistency, and accuracy.

WHY IS COUNTERPARTY OVERSIGHT IMPORTANT?

Hi, my name is Lisa Pizula and I'm a Director of Client Solutions. There are just so many benefits of a comprehensive counterparty oversight solution! For example, our functionality can help you avoid redundant workflows, low-producing partners, and unnecessary onboarding and review costs. While these time and cost savings are great, it is also so important to safeguard your relationships and liability by meeting regulatory requirements. I encourage you to contact our team for more information, we are ready to help.

ENHANCEMENTS

MAXIMIZE THE POWER OF COUNTERPARTY OVERSIGHT

With our advanced API integrations, you can easily gain access to counterparty data and use it in any system. Automatically populate data into your LOS system to effortlessly create accounts and quickly pull up customer accounts in your CRM.

INSIGHTS

MAXIMIZE TPO RELATIONSHIPS & MINIMIZE OVERSIGHT RISK

Conducting annual reviews on third-party originators has always been a time-consuming task. Even with automation and technical efficiencies in the quality control arena, resources are often allocated to areas that demand more constant oversight efforts than renewals. This has led a significant percentage of third-party investors to fall back on manual processes for their annual renewals. Download our Third-Party Best Practices & Checklist to learn how to maximize TPO relationships and minimize oversight risk!

ACCELERATE YOUR BUSINESS

Leverage Optimal Blue's comprehensive suite of investor management solutions to grow relationships, increase engagement, transact, mitigate risk, and identify new and profitable opportunities.