PRODUCT & PRICING for Mortgage Lenders

Win more business by providing borrowers the right product at the best price for any mortgage financing scenario.

Our product and pricing solution delivers the most comprehensive functionality, enhances workflow efficiencies, and enables lenders to stay competitive and confidently execute profitable lending strategies.

QUOTE ACCURATELY

ENHANCE YOUR QUOTING WITH BESTX™ PRICING

Accurately quote the absolute best mortgage pricing each and every time. With Optimal Blue's BESTX pricing capabilities, lenders can customize their BESTX to their unique business need.

Scenario-specific pricing

Best pricing alternatives

Side-by-side price comparisons

Create custom blended pricing

COMPETE MORE EFFECTIVELY

EXPAND YOUR PRODUCT OFFERING

Compete and differentiate your mortgage operation like never before. Leverage Optimal Blue to gain access to hundreds of investors offering thousands of mortgage products. Robust product support for all mortgage types, including:

Conforming

Non-conforming

Government

Housing Finance Authority

Expanded guidelines

Portfolio

Construction-only

Construction-to-permanent

CREATE EFFICIENCIES

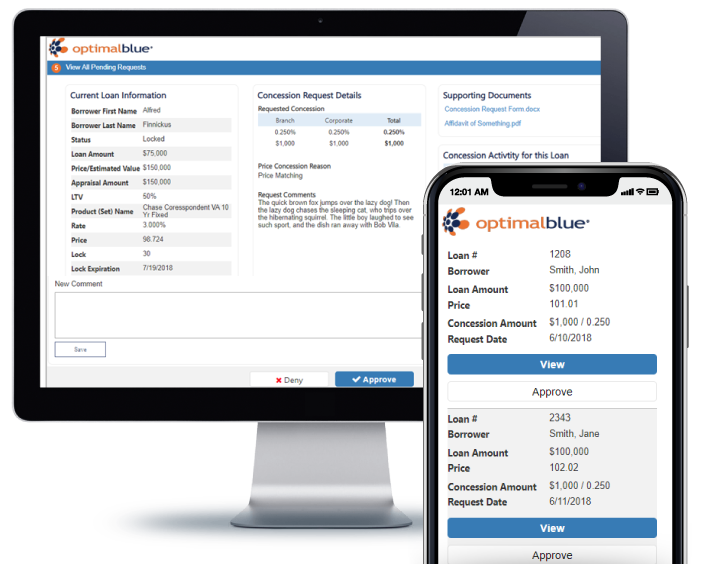

WORK SMARTER WITH LIGHTS-OUT LOCK DESK

Create new efficiencies and save valuable time by automating key workflows within your lock desk. There are several ways to automate, all of which can be tailored to your specific operational processes. Pick and choose where you leverage auto-accepting throughout workflows like:

Lock requests

Price concessions

Lock extensions

Profile and product changes

Relocks

EXCEED EXPECTATIONS

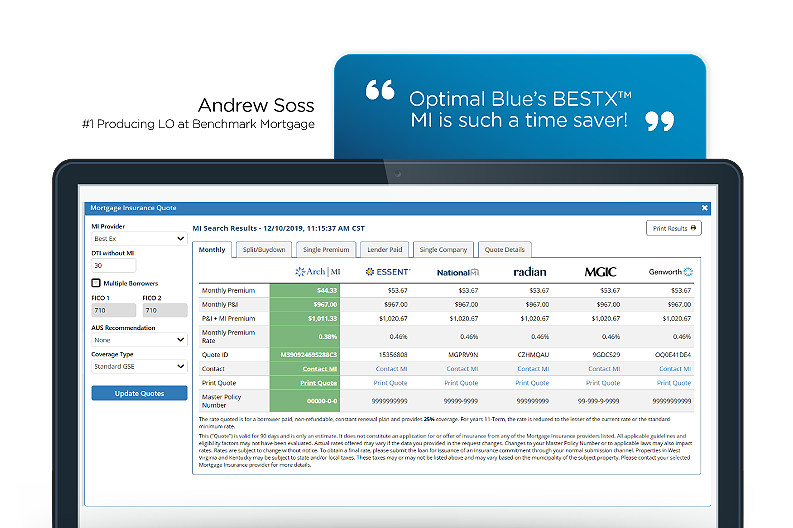

UTILIZE BESTX FOR MORE THAN JUST RATES

Exceed consumer expectations by providing them the lowest mortgage insurance premiums across all six MI providers. With Optimal Blue's BESTX MI service, lenders benefit from:

Client and scenario-specific premiums

Side-by-side price comparisons

Premium type comparisons

Best pricing alternatives

Turn Secondary marketing into a profit center

We see Optimal Blue as a profit center, we don't see it as a cost. The way that we are able to strategize our pricing actually turns Optimal Blue from a monthly cost to a net/net gain in that $20,000–$30,000 per month range.

WHAT SHOULD YOU LOOK FOR IN A PPE?

I’m Tiffany McGarry, Director of Product Management for our industry leading Product & Pricing Solution. For close to two decades, Optimal Blue has been leading the industry with product and pricing innovation. We are continually enhancing the functionality of our PPE to deliver what lenders need to better serve borrowers and compete more effectively. We would love to share what we've learned through a personalized, no-cost consultation to provide you with a new and fresh perspective on what to look for in a PPE!

ENHANCEMENTS

MAXIMIZE THE POWER

OF YOUR PPE

Generate more leads and enhance the consumer experience with accurate, compliant pricing tools, like:

Quick Quote

Featured Rates

Target Rate Emails

INSIGHTS

6 ESSENTIAL CONSIDERATIONS FOR CHOOSING A PPE

To stay competitive in today’smortgage market, lenders must evaluate their product, pricing, and eligibility (PPE) engine to ensure they’re maximizing profitability on every loan transaction. This white paper outlines six key considerations that can help lenders enhance efficiency, improve decision-making, and drive growth.